Pharmacies make more money on generic drugs than brand-name ones - even though generics cost far less and make up 90% of prescriptions. That’s the paradox at the heart of pharmacy economics today. You’d think high-priced brand drugs would be the profit engine. But they’re not. In fact, generics account for 96% of a pharmacy’s profit margin, even though they only represent about 29% of total sales. Meanwhile, brand drugs - which make up 71% of sales - contribute just 4% of the margin. This isn’t a glitch. It’s the system.

How Generics Became the Profit Engine

Generic drugs aren’t cheap because they’re low quality. They’re cheap because competition drives prices down. Once a brand drug’s patent expires, multiple manufacturers can produce the same medicine. The FDA approves these generics after proving they’re identical in effectiveness and safety. That’s why a 30-day supply of generic lisinopril might cost $4, while the brand version, Zestril, could cost $150.

Pharmacies don’t make much on the price difference - they make it on the markup percentage. A $4 generic drug might be sold for $12. That’s a 200% markup. A $150 brand drug might be sold for $160 - only a 6.7% markup. Even though the brand drug brings in more dollars, the percentage gain is tiny. Generics, by contrast, give pharmacies a much bigger slice of the pie relative to their cost.

According to the Schaeffer Center’s 2022 analysis, pharmacies average a 42.7% gross margin on generic drugs. For brand drugs, it’s just 3.5%. That’s why a single pharmacy might fill 500 generic prescriptions a day and only 50 brand ones - but still pull in 90% of its profit from the generics.

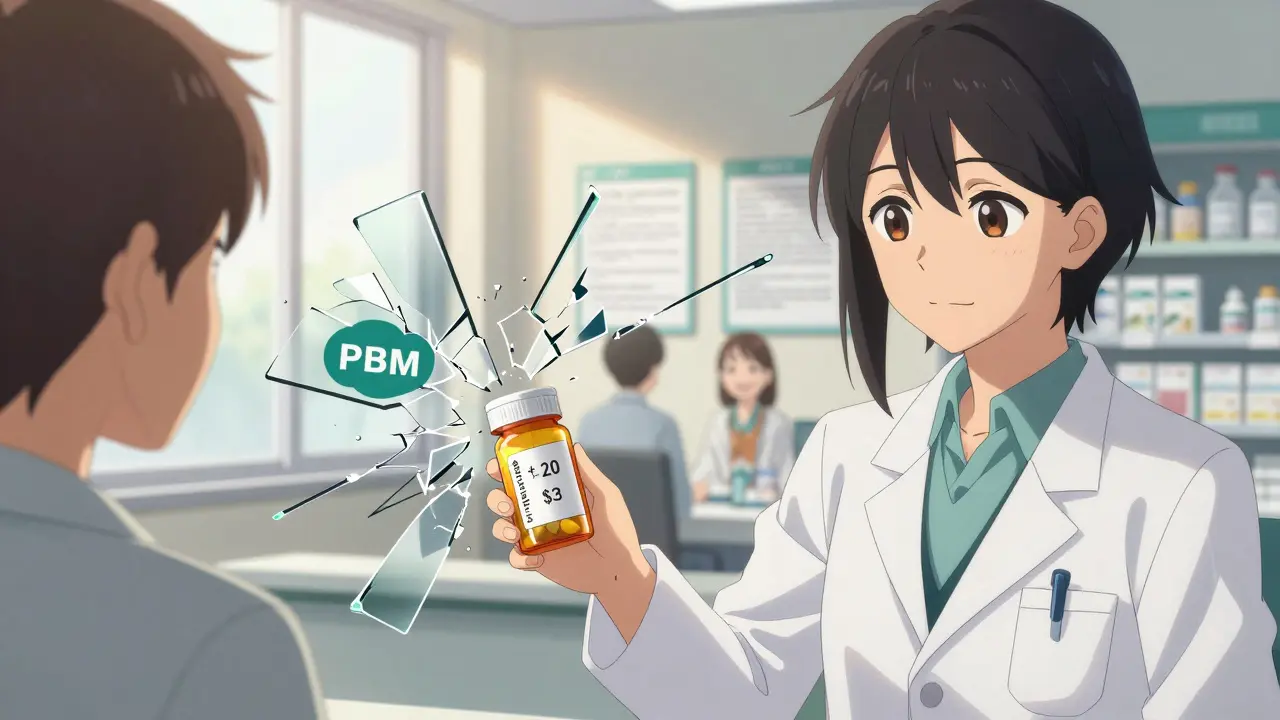

The Hidden Players: PBMs and Spread Pricing

But here’s the catch: pharmacies don’t get to keep most of that margin. Enter pharmacy benefit managers - or PBMs. These are the middlemen between pharmacies, insurers, and drug manufacturers. They negotiate drug prices, manage formularies, and handle claims. And they make money through something called spread pricing.

Here’s how it works: A PBM tells an insurance plan, “We’ll cover this generic drug for $15.” But when the pharmacy submits the claim, the PBM only pays the pharmacy $10. The $5 difference? That’s the PBM’s profit. The pharmacy never sees the $15. The patient pays $10 (or nothing, if covered). The PBM pockets $5. And the pharmacy? It’s stuck with the cost of staffing, rent, inventory, and compliance - all while being paid less than the market rate.

According to Prosperous America’s 2023 report, 64% of what Americans spend on prescriptions goes to middlemen - not drug makers, not pharmacies, but PBMs and other intermediaries. And PBMs make four times more profit on generic drugs than on brand drugs. That’s why the same $4 generic can be priced differently depending on who’s paying - and why independent pharmacies are bleeding money.

Why Independent Pharmacies Are Struggling

Chain pharmacies like CVS or Walgreens have leverage. They can negotiate better rates with PBMs because they fill millions of prescriptions. They also own their own PBMs. But independent pharmacies? They’re at the mercy of the system.

A 2022 survey by the National Community Pharmacists Association found that 68% of independent pharmacy owners listed declining generic reimbursement as their biggest threat. Between 2015 and 2022, gross margins on generics dropped from 24.6% to 19.8%. And net profit? It’s often below 2%. After payroll, utilities, rent, insurance, and software fees, many independents are barely breaking even.

And it’s getting worse. Some generics are now made by only one manufacturer - called single-source generics. Without competition, prices spike. In some cases, a single-source generic costs more than the original brand. One Ohio pharmacy owner told Pharmacy Times, “My net profit on generics has dropped from 8-10% five years ago to barely 2% now, while my overhead has increased 35%.”

That’s why over 3,000 independent pharmacies closed between 2018 and 2023. Many couldn’t survive the squeeze.

Mail-Order vs. Retail: A Stark Divide

The gap between mail-order and retail pharmacies is even more extreme. Mail-order pharmacies - often owned by PBMs - make far more on generics than local pharmacies do.

According to 3Axis Advisors’ 2024 analysis, mail-order pharmacies make over four times the margin on generics compared to grocery store pharmacies. For certain brand drugs with no transparency in pricing, mail-order pharmacies make up to 1,000 times more margin on generics than small retail pharmacies do. Why? Because they control the entire pipeline - from PBM to distribution to delivery. They don’t need to pay rent, hire local staff, or deal with walk-in customers. They’re built for scale, not service.

For the average person, this means two things: If you’re buying your meds in person, you’re paying more and getting less profit for the pharmacy. If you’re using mail-order, you’re likely paying less - but the real profit is going to a corporate entity you never see.

What’s Being Done to Fix It?

Some pharmacies are fighting back. A growing number are cutting out PBMs entirely. They’re offering direct cash-pay pricing - no insurance, no middleman. Mark Cuban’s Cost Plus Drug Company charges $20 for a generic drug plus a $3 dispensing fee. Amazon Pharmacy does something similar: $5 for generics, with full cost breakdowns. These models are transparent. They’re simple. And they’re growing fast.

Other pharmacies are shifting focus. Instead of relying on pill sales, they’re offering medication therapy management (MTM) services - helping patients understand their drugs, avoid interactions, and stay on track. These services are reimbursed separately by insurers and can add 3-5% to net margins. Some independents are also becoming certified specialty pharmacies, handling complex drugs for conditions like MS or cancer. Those drugs pay better and come with fewer reimbursement headaches.

States are stepping in too. California, Texas, and Illinois passed laws in 2022-2023 requiring PBMs to disclose how much they pay pharmacies. The FTC is investigating PBM practices. And the Inflation Reduction Act, which starts drug price negotiations for Medicare in 2026, could reduce overall drug spending - which might ease pressure on generic margins.

The Bottom Line: Profit Isn’t About Price - It’s About Control

Generics aren’t profitable because they’re expensive. They’re profitable because they’re cheap - and pharmacies can mark them up high. But PBMs have taken control of the pricing game. They’re the ones setting the reimbursement rates, hiding the spreads, and squeezing out small players.

The system was designed to save money. But instead, it created a profit pipeline that funnels money away from the people who actually dispense the drugs - the pharmacists and pharmacy staff - and into corporate boards and shareholder pockets.

Until there’s real transparency, real competition, and real reform, pharmacies will keep making the bulk of their money on the cheapest drugs - while barely surviving.

What This Means for Patients

You might think, “If pharmacies make so much on generics, why am I paying so much?” The answer: You’re not paying the pharmacy. You’re paying the PBM’s inflated price - and the pharmacy gets paid less than it needs to stay open.

If you’re on a fixed income, ask your pharmacist about cash prices. Sometimes, paying out of pocket is cheaper than using insurance. If your pharmacy offers MTM services, sign up. It’s free, it’s valuable, and it helps them stay in business.

And if you’re ever confused about why a $4 generic costs $12 at your local pharmacy - now you know. It’s not the pharmacy that’s marking it up. It’s the system.