When you pick up a prescription, the price on the receipt can feel random. One pill costs $3, another costs $300-even if they’re the same medicine. The difference? Generics versus brand-name drugs. Most people assume generics are cheaper, and they’re right. But the real story is messier. Your insurance plan, the drug’s place in the system, and even the pharmacy you use can flip the script and make a generic cost more than the brand. Here’s what actually happens when you pay for meds out of your own pocket.

Generics Are Usually Way Cheaper-But Not Always

Generic drugs contain the exact same active ingredients as their brand-name versions. They work the same way. They’re just made by different companies after the original patent expires. The FDA requires them to meet the same safety and effectiveness standards. So why the price gap? Because brand-name companies spent millions developing the drug and then charge for that investment. Generics skip that step.

On average, generics cost 80 to 85% less than brand-name drugs. Nine out of every 10 prescriptions filled in the U.S. are for generics. That’s a huge number. But here’s the twist: even though generics make up 90% of prescriptions, they only account for about 18% of total prescription spending. Why? Because the other 10%-the brand-name drugs-are priced so high they drag the whole cost up.

Take omeprazole. The brand version, Prilosec, used to cost $200 for a 30-day supply. The generic? Around $10. That’s a 95% drop. Same medicine. Same results. But not every generic follows this pattern.

Your Insurance Plan Is the Hidden Factor

How much you pay doesn’t just depend on the drug. It depends on your insurance design. There are three main ways plans charge you: copay, coinsurance, or deductible.

If you have a flat $10 copay for generics, it doesn’t matter if the drug’s list price jumps from $15 to $50. You still pay $10. But if you’re on coinsurance-say, 20% of the drug’s cost-you’re on the hook for every price hike. When brand-name manufacturers raise prices by 16.7% over two years (as seen in a 2021 JAMA study), patients with coinsurance pay more. Those with copays? They’re shielded.

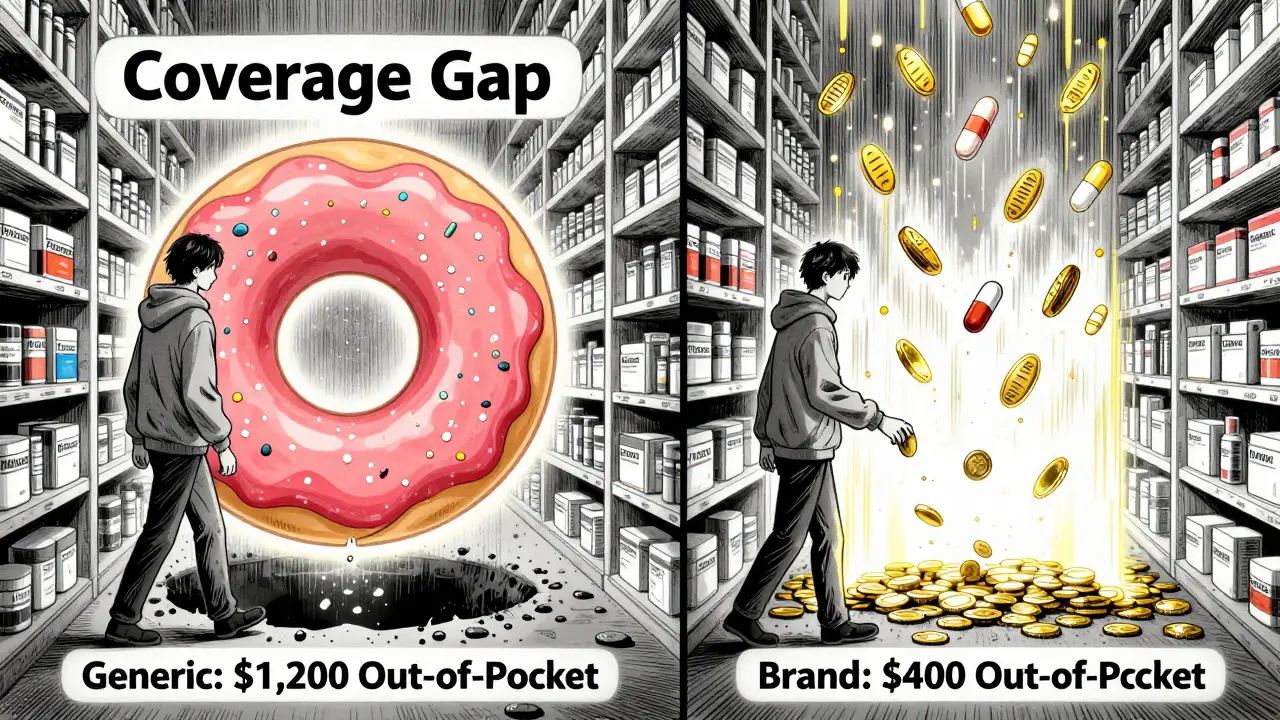

Medicare Part D enrollees face an even stranger situation. In the coverage gap-called the “donut hole”-brand-name manufacturers give discounts that count toward your out-of-pocket spending. Generics? No discounts. So if you’re taking a high-cost generic like gabapentin, you might have to spend nearly $4,000 to reach catastrophic coverage. For a brand-name drug, you’d hit that same point at under $1,000. That means you pay more out of pocket for the cheaper drug just because the system doesn’t reward it.

Why Some Generics Cost More Than Brands

This isn’t theoretical. In 2019, researchers found patients on Medicare Part D paid more out of pocket for certain high-priced generics than for their brand-name equivalents. Why? The math behind the donut hole. Brand-name drugs come with built-in rebates that reduce your spending count. Generics don’t. So even if the generic’s list price is lower, you have to spend more to get out of the gap.

For example, a $1,200 generic drug might require you to pay $1,200 out of pocket to reach catastrophic coverage. A $1,500 brand-name drug? Thanks to the manufacturer’s discount, you only pay $400 toward your out-of-pocket total. The brand costs more upfront, but you get to the safety net faster. That’s not a bug-it’s how the system is built.

What About the Uninsured?

If you don’t have insurance, you’re not stuck with the pharmacy’s list price. Cash-paying customers can find better deals. Companies like Mark Cuban Cost Plus Drug Company and Blueberry Pharmacy sell generics at transparent, low prices-often lower than what insurance pays. A 2024 study found patients saved $4.96 on average per prescription using these cash-only pharmacies. For 11.8% of generics, the savings were significant.

But here’s the catch: only 4% of all U.S. prescriptions are paid in cash. And 97% of those cash payments are for generics. Why? Because if you’re paying out of pocket, you’re avoiding the middlemen-pharmacy benefit managers (PBMs), insurers, and distributors-who inflate prices. You’re buying directly from the manufacturer or a low-overhead pharmacy. For uninsured patients, this is often the only way to afford meds.

Why Are Generics So Expensive Sometimes?

Even when generics are supposed to be cheap, they can cost too much. Why? Market distortions. The system has layers of middlemen. PBMs negotiate rebates with drugmakers, but those rebates don’t go to you. They go to insurers or pharmacy chains. Meanwhile, the list price you see at the counter keeps climbing. A 2022 analysis from the USC Schaeffer Center found patients overpay for generics by 13 to 20% because of this opaque pricing.

It’s not that generics are expensive. It’s that the system hides how cheap they could be. One study showed that while out-of-pocket costs for generics dropped by 50% over a few years, the total cost (what insurers paid plus what patients paid) dropped by nearly 80%. That means insurers are getting bigger discounts, but you’re not seeing it.

Can You Force Your Doctor to Prescribe a Generic?

You can ask. But your doctor has to agree. Some doctors write “dispense as written” or “do not substitute” on prescriptions. That means the pharmacist can’t switch to a generic, even if it’s cheaper. Reasons vary: maybe the brand has a unique delivery system, or the patient had a bad reaction to a generic in the past. But often, it’s habit-or the doctor doesn’t know the generic is equivalent.

If you want the cheaper option, ask. Say: “Is there a generic version? Can we use it?” Most of the time, the answer is yes. If your doctor says no, ask why. If it’s not a medical reason, you can push back. You’re the one paying.

What Can You Do to Pay Less?

Here’s what works in real life:

- Always ask for the generic. Even if you’re on insurance.

- Compare prices. Use GoodRx or SingleCare. Sometimes cash price is lower than your insurance copay.

- Check if your pharmacy offers a discount program. Walmart and Target sell many generics for $4 or less.

- If you’re on Medicare Part D, look at your plan’s formulary. Some plans put high-cost generics in higher tiers.

- For expensive generics, try cash-only pharmacies like Mark Cuban Cost Plus Drug Company. They’re not for everyone, but they save money on the drugs they carry.

- If your drug is in the donut hole, ask your doctor if there’s a brand-name alternative with manufacturer assistance. Some companies offer coupons that cut your cost dramatically.

The Bigger Picture

The system isn’t broken-it’s designed this way. Drugmakers raise prices to fund R&D. Insurers negotiate rebates to keep premiums low. PBMs take a cut. Patients get stuck in the middle. Generics were supposed to fix this. They did-by volume. But not by cost control.

Medicare Part D is the clearest example of a system that rewards higher prices. Until policy changes-like capping out-of-pocket spending or requiring generics to get the same discounts as brands-patients will keep paying more for cheaper drugs.

For now, the best tool you have is knowledge. Know your plan. Know your options. And never assume the lowest-priced drug is the cheapest for you. Sometimes, the most expensive one is the one that saves you the most.

Are generic drugs as safe and effective as brand-name drugs?

Yes. The FDA requires generic drugs to have the same active ingredients, strength, dosage form, and route of administration as the brand-name version. They must also prove they work the same way in the body. Differences in fillers or color don’t affect safety or effectiveness. Most pharmacists and doctors agree generics are just as good.

Why does my insurance make me pay more for a generic than a brand-name drug?

This usually happens with Medicare Part D. Brand-name drugs come with manufacturer discounts that count toward your out-of-pocket spending in the coverage gap. Generics don’t. So even if the generic costs less, you have to spend more to reach catastrophic coverage. It’s a flaw in the system, not a mistake by your pharmacy.

Can I save money by paying cash for generics instead of using insurance?

Yes, often. Many cash-only pharmacies like Mark Cuban Cost Plus Drug Company or GoodRx partners sell generics at prices lower than your insurance copay. This is especially true for expensive generics or if you have a high-deductible plan. Always check the cash price before swiping your card.

What should I do if my doctor refuses to prescribe a generic?

Ask why. If the reason is cost, convenience, or habit-not medical necessity-you can request a generic. If your doctor says the brand is needed, ask for documentation. Some insurers require prior authorization for brand-name drugs. You have the right to ask for the cheaper option unless there’s a real clinical reason not to.

Do all pharmacies charge the same price for generics?

No. Prices vary widely. A generic might cost $12 at CVS, $4 at Walmart, and $2 at a cash-only pharmacy. Pharmacy benefit managers set prices differently for each location. Always compare. Use tools like GoodRx to find the lowest price near you.

Why do brand-name drugs cost so much more than generics?

Brand-name companies recoup the cost of research, development, and marketing. Once the patent expires, other companies can make the same drug without those costs. Generics don’t need to run expensive clinical trials-they just prove they work the same. The price difference reflects that, not quality.

Are there any generics that aren’t worth using?

Rarely. For most drugs, generics are identical. But for a few narrow-therapeutic-index drugs-like warfarin, levothyroxine, or phenytoin-small differences in absorption can matter. In those cases, your doctor may recommend sticking with one brand or generic. Always monitor your response and tell your doctor if you notice changes after switching.