When a brand-name drug loses its patent, most people assume the company walks away from the market. But that’s not what happens. Instead, you’ll often see the same company launch a version of the drug - identical in every way - under a different name, at a fraction of the price. This is an authorized generic. And it’s not a mistake. It’s a calculated move.

What Exactly Is an Authorized Generic?

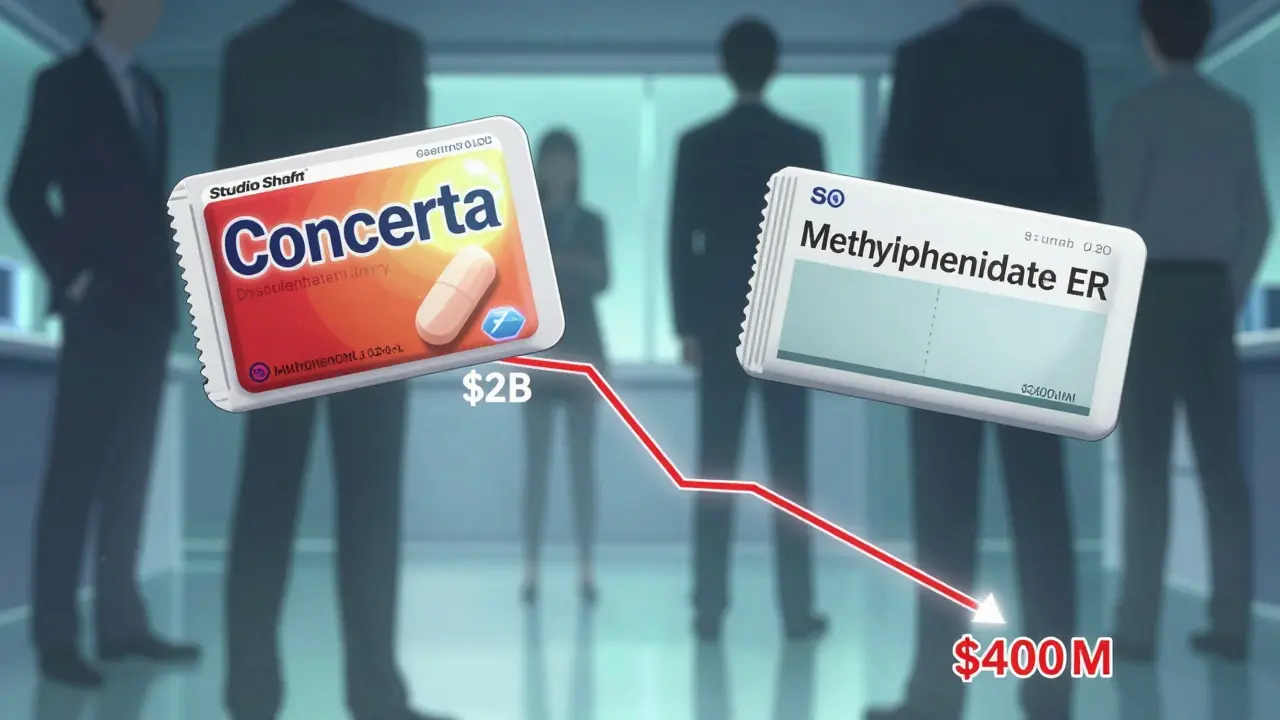

An authorized generic is the exact same pill, capsule, or injection as the brand-name drug. Same active ingredient. Same inactive ingredients. Same manufacturing process. The only differences? The label says something like "Methylphenidate ER" instead of "Concerta," and the color or markings on the pill might be slightly different. It’s not a copy. It’s the real thing, sold without the brand name. These aren’t made by a rival company. They’re produced by the original brand manufacturer - often through a subsidiary like Greenstone (Pfizer’s authorized generic arm) or Prasco. They’re sold under the original FDA-approved New Drug Application (NDA), so they skip the lengthy ANDA process that traditional generics go through. That means they hit the market faster, sometimes before the first generic even arrives.Why Do Brand Companies Do This?

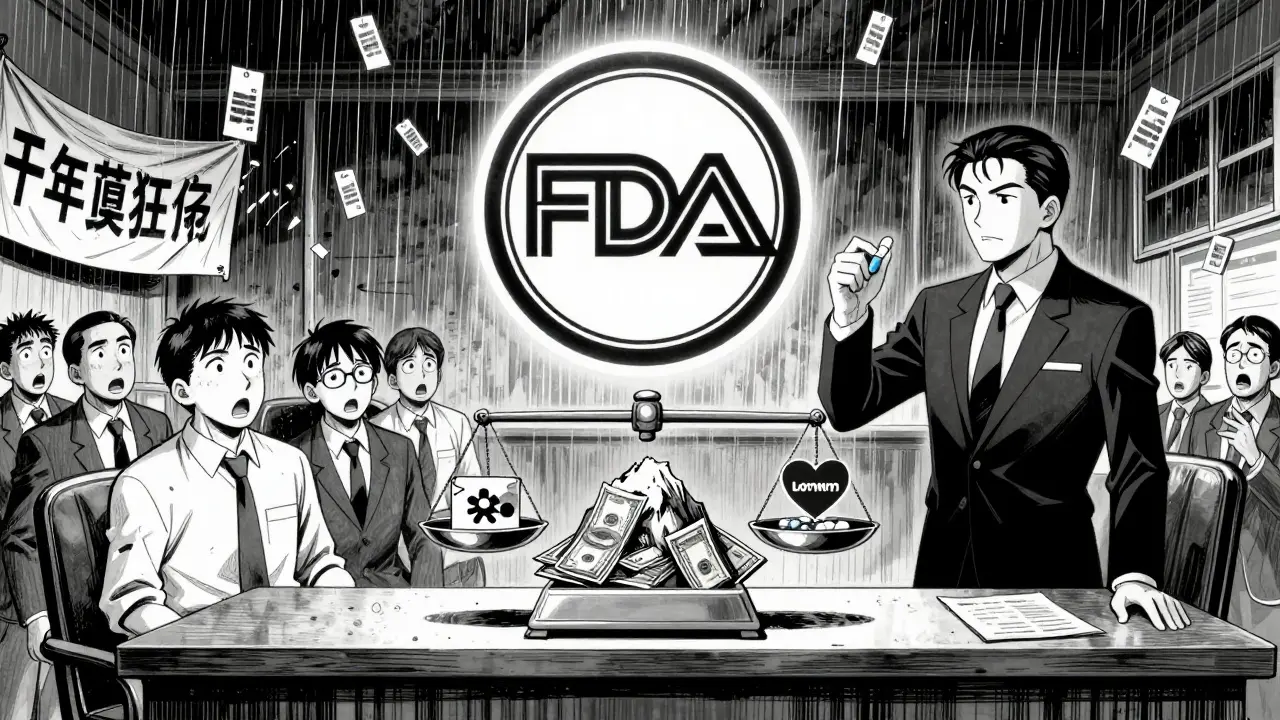

It seems counterintuitive. Why would a company help kill its own high-margin product? The answer is simple: to survive the fall. When a blockbuster drug loses patent protection, revenue typically drops 80-90% in the first year. That’s not a slow decline. It’s a cliff. And if you do nothing, you lose everything. Authorized generics let you hold on to part of that market. Take a drug like Celebrex, which once brought in over $2 billion a year. When generics entered, Pfizer didn’t just watch. They launched an authorized generic of celecoxib. Now, instead of losing 100% of the market to competitors, they kept 15-20% of sales - still millions in revenue - while letting the rest go to cheaper alternatives.The Hatch-Waxman Act and the 180-Day Advantage

The U.S. drug market runs on a law called the Hatch-Waxman Act. It gives the first generic company to challenge a patent a 180-day exclusivity period. During that time, no other generic can enter. That’s a golden window - the first generic can charge near-brand prices and rake in massive profits. But here’s where brand companies strike back. About 70% of authorized generics launch before or during that 180-day window. That means the first generic isn’t alone. They’re suddenly competing against their own brand’s version - identical in every way - but priced like a generic. The Federal Trade Commission found this drives prices down hard. In markets with authorized generics, the first generic’s profits shrink. Sometimes by half. That’s not just good for consumers - it’s a warning to other generics: if you think you’re going to cash in on exclusivity, think again. The brand company is already in the game.Segmenting the Market - Two Prices, One Drug

Brand companies don’t just want to survive. They want to optimize. They use authorized generics to split the market. On one side: patients and insurers willing to pay more for the trusted brand name. On the other: cost-conscious buyers - Medicaid, Medicare Part D, mail-order pharmacies, and people paying out-of-pocket - who grab the cheaper version. This isn’t just about price. It’s about control. By offering the authorized generic themselves, they decide where it’s sold. Maybe it’s only available through CVS mail-order. Or only through certain pharmacy chains. That keeps it from directly competing on the same shelf as the brand. No one sees the $2 authorized generic next to the $15 brand-name pill. The brand stays premium. The generic stays affordable. Both make money.

Why Not Just Let Traditional Generics Take Over?

You might think: if the drug’s off-patent, why not let other companies make generics? The problem isn’t the active ingredient. It’s the rest. Traditional generics only need to prove they’re bioequivalent - meaning the body absorbs them the same way. But they can use different fillers, dyes, or coatings. For most drugs, that’s fine. For others - like blood thinners, epilepsy meds, or thyroid drugs - even tiny differences can cause problems. Patients on these drugs often get prescribed the brand because they’ve had bad reactions to generics. Authorized generics solve that. They’re the exact same formulation. No surprises. No switching side effects. That’s why over 80% of Americans say they want the option of an authorized generic, according to Roper Public Affairs. Brand companies know this. They’re not just protecting revenue - they’re protecting trust.It’s Not Just Defense - It’s Offense

In the past, authorized generics were mostly a reaction. Companies waited until generics showed up, then responded. Now, it’s proactive. From 2020 to 2023, more brand companies launched authorized generics before any generic even filed for approval. It’s a preemptive strike. They’re saying: if you’re thinking about entering this market, we’re already here. You won’t get a monopoly. You won’t get the 180-day windfall. We’re taking the first move. This shift shows how sophisticated the strategy has become. It’s no longer about damage control. It’s about shaping the market before it even forms.What’s Next? Authorized Biosimilars

The same logic is now being applied to biologics - complex drugs made from living cells, like Humira or Enbrel. These are the new billion-dollar drugs. And their patents are starting to expire. The FDA hasn’t officially defined "authorized biosimilars" yet. But companies are testing the waters. Why? Because the same playbook works. If you’re the original maker of a biologic, why let a competitor capture the first wave of savings? Launch your own version. Keep control. Keep trust. Keep revenue. It’s not guaranteed to be legal. It’s not guaranteed to be approved. But the incentives are too strong to ignore.

Who Wins? Who Loses?

Consumers win. Prices drop faster. More options appear. Fewer people are priced out. Insurers and government programs win. Lower drug costs mean lower premiums and fewer budget overruns. Brand companies win. They preserve millions in revenue. They keep their manufacturing plants running. They maintain relationships with prescribers who trust their formulation. Traditional generic manufacturers? They lose some of the upside. The 180-day monopoly? It’s been broken. The chance to charge high prices? It’s been crushed by the brand’s own version. But here’s the twist: some generics still win. They just have to be smarter. They have to focus on drugs where the brand didn’t launch an authorized version. Or they have to offer something better - like lower pricing, better packaging, or faster delivery.It’s Not Cheating. It’s Capitalism.

Some call this strategy manipulative. Others call it predatory. But it’s legal. It’s transparent. And it’s been happening for over 20 years. The brand companies aren’t hiding anything. The authorized generic is clearly labeled. It’s listed in the same databases as other generics. Pharmacists know it. Doctors know it. Patients can ask for it. This isn’t a loophole. It’s a feature of the system. The FDA allows it. The FTC monitors it. And consumers keep choosing it. In a world where drug prices are under constant scrutiny, authorized generics are one of the few things that actually bring prices down - without breaking the rules.What Should You Do?

If you’re a patient: Ask your pharmacist if an authorized generic is available for your prescription. It’s often cheaper than the brand - and just as effective. If you’re a payer (insurance, Medicare, employer): Push for authorized generics in your formulary. They deliver the same clinical outcome at a lower cost. If you’re in the industry: Understand that this isn’t going away. It’s becoming more common. The days of easy generic monopolies are over. The game has changed. The bottom line? Authorized generics aren’t a glitch in the system. They’re a feature. And they’re here to stay.Are authorized generics the same as brand-name drugs?

Yes. Authorized generics contain the exact same active and inactive ingredients, dosage form, strength, and route of administration as the brand-name drug. The only differences are the label, packaging, and sometimes minor color or shape changes to distinguish them from the branded version. They’re made by the same company, on the same line, using the same process.

Why are authorized generics cheaper than the brand?

They’re cheaper because they don’t carry the marketing, advertising, and R&D costs associated with the brand name. The brand company still makes them, but they sell them without the premium pricing. Since they’re not competing against other generics, they don’t need to slash prices as deeply - but they still offer significant savings, often 20-50% less than the brand.

Can I ask my pharmacist for an authorized generic?

Absolutely. Authorized generics are listed in the same drug databases as traditional generics. You can ask your pharmacist, "Is there an authorized generic for this drug?" They’ll know. In many cases, they’ll even suggest it if it’s available and cheaper than the brand.

Do authorized generics have the same side effects as the brand?

Yes. Because they’re identical in formulation, side effects are the same. This is especially important for drugs with narrow therapeutic windows - like warfarin, levothyroxine, or phenytoin - where even small differences in inactive ingredients can affect how the drug works. Authorized generics eliminate that risk.

Why don’t all brand companies launch authorized generics?

It depends on the drug, the market, and the company’s strategy. For lower-value drugs, the cost of running a separate generic line isn’t worth it. Some companies prefer to exit the market entirely. Others rely on loyalty or patent extensions. But for high-revenue drugs - especially those with complex formulations - launching an authorized generic is now standard practice.