When a brand-name drug’s patent runs out, you’d expect a flood of cheap generics from other companies. But here’s the twist: sometimes, the same company that made the brand-name pill starts selling its own generic version. It’s not a trick. It’s called an authorized generic. And it’s becoming more common than you think.

What Exactly Is an Authorized Generic?

An authorized generic is the exact same drug as the brand-name version-same active ingredient, same inactive ingredients, same size, color, shape, and how it works in your body. The only differences? The packaging and the label. It doesn’t have the brand name on it. Instead, it says something like "Omeprazole 20 mg" instead of "Prilosec." It’s made in the same factory, by the same team, using the same equipment as the brand-name drug. The FDA requires it to meet the same quality and safety standards. In fact, bioequivalence rates are 99.7%, according to FDA data. That means your body absorbs it the same way. If you’ve been taking a brand drug for years, switching to its authorized generic feels like taking the same pill-just cheaper.Why Do Brand Companies Make Their Own Generics?

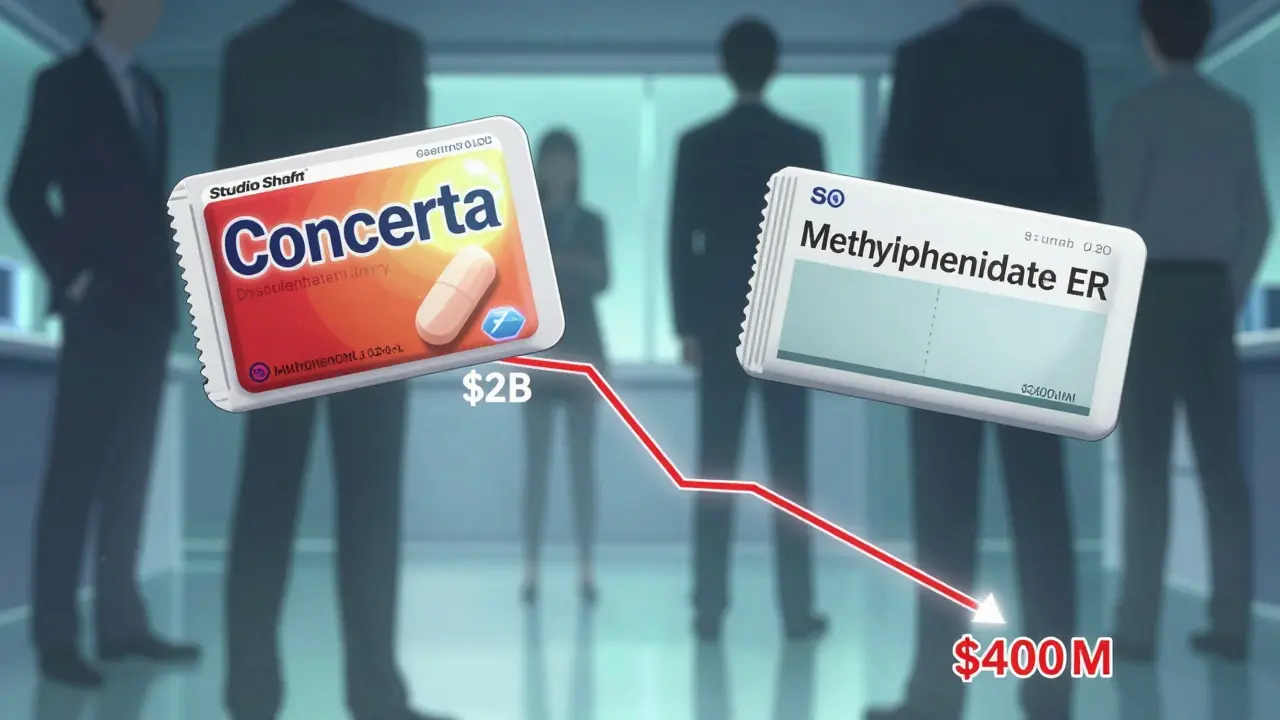

It sounds strange. Why would a company help kill its own profits? The answer is survival. When a patent expires, other companies can legally make the same drug. These generics often drop the price by 80-85% within the first year. Without a plan, the brand manufacturer loses nearly all its sales. That’s a massive hit. So instead of watching competitors take over, many brands launch their own generic version. This lets them keep control. They still make the drug. They still get some revenue. And they stop other generic makers from grabbing the entire market. In 2019, Teva launched an authorized generic of Copaxone the exact day its patent expired. Within three months, it held 22% of the generic market. That’s not a small win-it’s a strategic takeover.How Is It Made? The Process Behind the Scenes

Producing an authorized generic isn’t like starting from scratch. The brand company already has everything: the manufacturing license, the FDA approvals, the data on safety and effectiveness. They don’t need to run new clinical trials. Instead, they file a simpler application called an ANDA-Abbreviated New Drug Application. The process takes 6 to 9 months to set up. That’s much faster than the 17-month average it takes for a new generic company to get approved. Why? Because they’re using the same facility, same formula, same quality checks. They just change the box and the label. For example, when Pfizer switched Prilosec to an authorized generic in 1997, they didn’t redesign the pill. They didn’t retrain workers. They just printed new labels. The production line kept running. The only real cost? Regulatory paperwork and marketing setup-around $15 to $25 million per product. But they recouped that investment in about 14 months, according to U.S. Pharmacist’s 2023 case study.

How Is It Priced? The Hidden Strategy

You might think an authorized generic would be the cheapest option. It’s not. It usually costs 10-15% less than the brand name, but 5-10% more than the competing generics. Why? Because it’s not meant to be the lowest price. It’s meant to be the smart middle ground. Take Cialis. When Eli Lilly launched its authorized generic in 2018, it priced it just below the brand version. Traditional generics were selling for $30 a pill. The authorized generic? $45. The brand? $50. Suddenly, patients had a familiar option that wasn’t the cheapest, but still felt safer. And it worked: 78% of the total market revenue stayed with Lilly, even after generics entered. This pricing strategy creates tiers. The brand stays for loyal customers who don’t care about cost. The authorized generic pulls in cost-conscious users who trust the name. And the cheapest generics? They get the bargain hunters-and often the least profitable segment.Is It Really Helping Patients?

The answer isn’t simple. On one hand, patients get a drug they already know and trust. Drugs.com reviews show higher satisfaction with authorized generics-4.2 out of 5 stars versus 3.8 for traditional generics. People write things like, “This is the same pill I’ve taken for 10 years.” That matters. Consistency reduces anxiety. But here’s the catch: most people don’t know they’re buying a version made by the same company. A 2023 Kaiser Family Foundation survey found 64% of patients had no idea the “generic” they were handed came from the brand manufacturer. Pharmacists report confusion too. One independent pharmacy owner told the National Community Pharmacists Association, “Patients ask why the generic costs more than the one down the street. I have to explain it’s the same pill, just labeled differently.” And the cost savings? They’re real-but not as big as they seem. Harvard’s Dr. Aaron Kesselheim found that markets with authorized generics saw only a 32% price drop. Markets with only traditional generics? 68%. That’s a huge difference. The FTC has even sued companies for using authorized generics to delay real competition. In 2017, Actavis paid $448 million to settle a case over its drug Namenda, where the authorized generic was seen as a tactic to block other generics.

What’s Changing in the Industry?

This strategy isn’t going away. In fact, it’s growing. Between 2020 and 2023, the top five drug companies-Pfizer, Johnson & Johnson, Roche, Merck, AbbVie-launched 47 authorized generics. That’s a 28% year-over-year increase. And it’s not just pills anymore. In 2023, Johnson & Johnson launched the first authorized generic of a long-acting injectable drug, Invega Sustenna. That’s a big deal. Injectables are harder to copy. Only the original maker has the right equipment and expertise. Even more surprising: the first authorized biosimilar was approved in 2023. Amgen launched its own version of Enbrel, a biologic drug. That’s the next frontier. Biologics are complex, expensive, and hard to replicate. If brand companies can make their own biosimilars, they’ll have even more control over the future of drug pricing. Analysts predict that by 2027, authorized generics will make up 25-30% of the total generic market-up from 18% in 2022. Why? Because as more complex drugs lose patents, only the original makers can produce them reliably. Traditional generic companies can’t keep up.What Should You Do as a Patient?

If you’re on a brand-name drug that’s about to go generic, ask your pharmacist: “Is there an authorized generic?” It might cost a little more than the cheapest option, but it’s the same drug you’ve been taking. No guesswork. No new side effects. Just the same pill in a different box. But don’t assume it’s the cheapest. Compare prices. Sometimes, a traditional generic from a different company is still cheaper. And if you’re on Medicare or private insurance, your plan might cover one version better than another. Bottom line: authorized generics aren’t a scam. They’re a business move. But for you, they can be a safe, familiar option when the brand name gets too expensive.Why This Matters for the Future of Drugs

Over the next five years, $250 billion worth of brand-name drugs will lose patent protection. That’s a massive shift. Companies can’t just rely on patents forever. They need a plan. Authorized generics are that plan. It’s not about being evil or noble. It’s about survival. The system rewards control. And if you’re the only one who knows how to make a drug, you’re going to use that knowledge to stay in the game. The real question isn’t whether authorized generics are good or bad. It’s whether we want a system where the same company controls both the brand and the cheapest version-and whether that’s fair to patients and taxpayers. For now, they’re here to stay. And if you’re taking a pill that’s losing its patent, you’ll likely see two versions on the shelf: one with a fancy name, and one with a plain label-and the same exact medicine inside.Are authorized generics the same as regular generics?

Yes and no. Authorized generics are made by the original brand company using the same formula, factory, and process as the brand-name drug. Regular generics are made by other companies and may have different inactive ingredients or slight variations in how they’re manufactured. But both must meet FDA bioequivalence standards. The key difference? Authorized generics are identical to the brand in every way except the label.

Why is an authorized generic sometimes more expensive than a regular generic?

Because it’s not meant to be the cheapest. Brand manufacturers price authorized generics just below the brand name to keep some revenue, but above competing generics to avoid undercutting their own brand. It’s a pricing strategy to capture customers who want familiarity without paying full price. The cheapest generic often comes from a company that doesn’t have the original manufacturing setup, so it can produce it cheaper.

Can I trust an authorized generic as much as the brand name?

Absolutely. Authorized generics are produced under the same FDA-approved conditions as the brand name. The same workers, same machines, same quality checks. The only difference is the box. Many patients report no change in how the drug works or how they feel after switching. In fact, patient satisfaction scores on Drugs.com are higher for authorized generics than for traditional ones.

Do insurance plans cover authorized generics differently?

Sometimes. Many insurance plans treat authorized generics the same as regular generics-meaning they’re placed in the lowest cost tier. But some plans may still list them under the brand name’s tier, especially if the manufacturer markets them as a premium option. Always check your plan’s formulary or ask your pharmacist to compare costs before switching.

Why don’t more companies use authorized generics?

They do-more than ever. But it’s not always possible. It requires significant upfront investment, regulatory planning, and internal coordination. Smaller companies don’t have the resources. Also, if a brand company doesn’t have a strong manufacturing footprint or fears legal pushback from the FTC, they may avoid it. Still, 68% of top 50 drugs that lost patents between 2018 and 2022 had authorized generic versions launched by the original maker.