Every year, millions of people pay their prescription copays without realizing they’re not helping them meet their deductible. That’s not a mistake-it’s how most health plans are designed. If you’re taking a daily medication like blood pressure pills or insulin, and you’ve paid $500 in $10 copays over the year, you might think you’re close to hitting your $1,500 deductible. You’re not. And that confusion costs people money-sometimes in the form of skipped doses or delayed care.

What an out-of-pocket maximum actually does

Your out-of-pocket maximum is the most you’ll pay in a year for covered services. Once you hit that number, your insurance pays 100% of everything else for the rest of the year. This isn’t optional. Since 2014, the Affordable Care Act made it mandatory for all new plans to include one. For 2026, the federal limit is $10,600 for an individual and $21,200 for a family. These caps protect you from medical bankruptcy.What counts toward that maximum? Deductibles, coinsurance, and copays-all of them. That includes your $5 generic pill copay, your $30 doctor visit copay, and your 20% coinsurance on an MRI. Every dollar you pay out of pocket for covered care adds up until you hit the ceiling.

Why generic copays don’t count toward your deductible

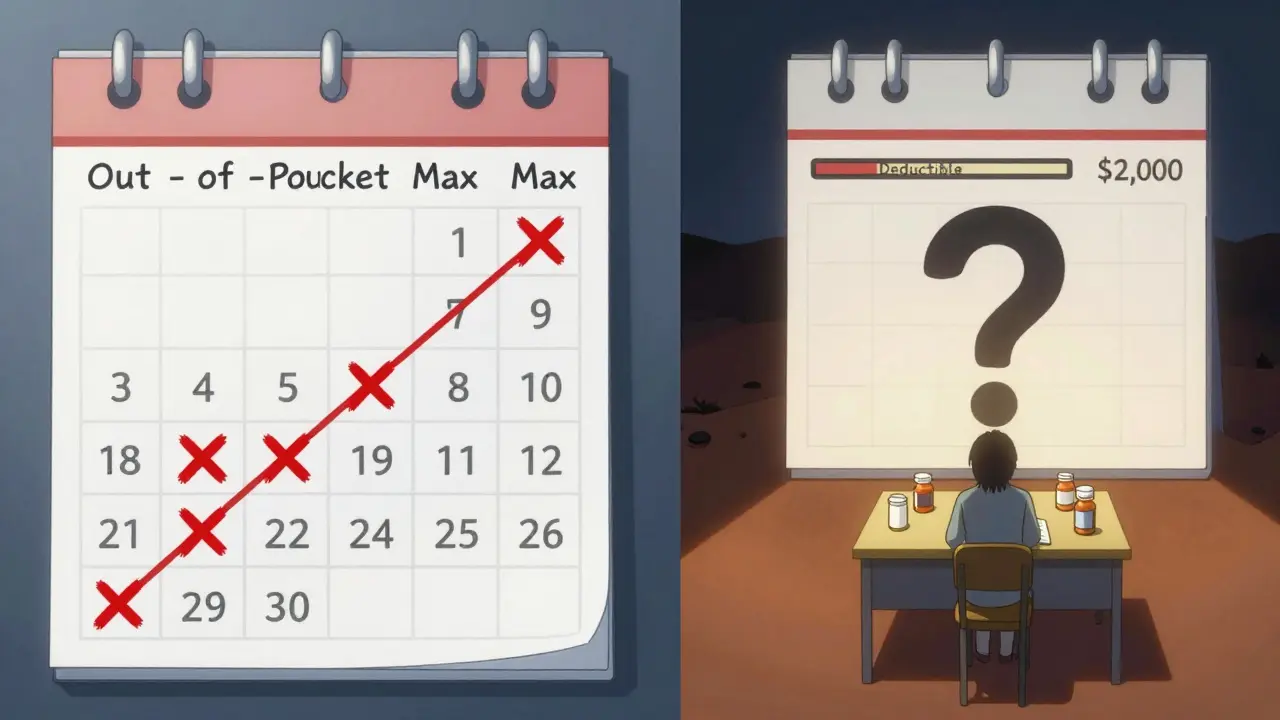

Here’s where it gets tricky. Even though your $10 copay for metformin counts toward your out-of-pocket maximum, it usually doesn’t count toward your deductible. That’s because most plans treat deductibles and copays as separate tracks.Think of it like two lanes on a highway. One lane (the deductible) requires you to pay full price until you hit a certain amount-say, $2,000. The other lane (copays) lets you pay a fixed fee each time, but that fee doesn’t move you forward on the deductible lane. You’re paying both, but only one gets you closer to the finish line.

For example: Your plan has a $2,000 medical deductible and $10 generic copays. You fill your prescription 15 times in January. You’ve paid $150 in copays. Your out-of-pocket maximum is now $150 closer to being met. But your deductible? Still $2,000. You didn’t chip away at it at all.

The three common plan designs you’ll see

Not all plans work the same way. There are three main structures you’ll run into:- Single deductible: One amount covers both doctor visits and prescriptions. You pay full price for meds until you hit $2,000, then you pay coinsurance or a copay. This is the simplest, but only used in about 27% of employer plans.

- Separate deductibles: You have a $2,000 medical deductible and a $1,000 prescription deductible. You pay full price for pills until you hit $1,000, then you get your $10 copay. The copays you pay after that count toward your out-of-pocket maximum, but not your medical deductible.

- Copay-only (no prescription deductible): You pay $10 every time you fill a generic script, no matter what. No deductible to meet. These copays count toward your out-of-pocket maximum but not your medical deductible.

The last two are the most common. That’s why so many people think their copays are helping them meet their deductible. They’re not. They’re helping them reach the out-of-pocket maximum-which is good, but not the same thing.

Why this confusion matters

People skip meds because they think they’ve already paid enough. A 2023 survey found 68% of consumers believed their prescription copays counted toward their deductible. Only 22% knew the truth. That misunderstanding leads to real harm. Diabetics delay insulin. Asthma patients don’t refill inhalers. High blood pressure goes untreated.One user on a health forum said she paid $2,500 in copays over a year, thinking she’d met her $2,000 deductible. When she went in for surgery, she was hit with another $2,000 bill because she hadn’t touched the deductible at all. She didn’t know copays didn’t count.

Experts call this the “valley of confusion.” You’re paying money. You feel like you’re making progress. But you’re not moving the needle on the part that unlocks lower costs for future care.

How to know what your plan actually does

You can’t guess. You have to check.Every plan must give you a Summary of Benefits and Coverage (SBC). Look for the section that says “Does this payment count toward my deductible?” Next to each cost-sharing item-copay, coinsurance, deductible-it will say yes or no.

Also check the Explanation of Coverage document you received before signing up. It’s longer, but it spells out exactly how each payment works. Don’t skip it. Spend 45 minutes reading it. It’s the only way to avoid surprises.

Look for these phrases:

- “Copays do not apply to the deductible.”

- “Prescription costs are subject to a separate deductible.”

- “All in-network cost-sharing counts toward your out-of-pocket maximum.”

If you’re on a Medicare Advantage plan or employer insurance, call the customer service line and ask: “Do my generic prescription copays count toward my medical deductible?” Record their answer. If they say yes, ask them to send you the plan document that says so.

What’s changing in 2025 and beyond

The government is pushing for clearer rules. Starting in 2025, insurers must make it much easier to understand how copays and deductibles work. New SBC forms will highlight this info in bold.Some insurers are testing “integrated deductible” plans-where prescription costs, including copays, count toward one single deductible. Early results show people take their meds more consistently. In five states, patients using these plans are 28% more likely to stick with their treatment.

By 2027, analysts predict 60% of major insurers will offer at least one plan where generic copays count toward the deductible. But that’s not here yet. Right now, the default is still separation.

What you should do right now

If you’re on a plan with generic copays:- Find your SBC document. Open it. Look for the deductible section.

- Check if your prescription copays count toward your medical deductible. If it says “no,” you’re not making progress there.

- Track your out-of-pocket spending. Add up all your copays, coinsurance, and deductible payments. When you hit your max, your meds become free.

- If you take daily meds, calculate how many copays it’ll take to hit your out-of-pocket maximum. That’s your real goal.

For example: If your out-of-pocket max is $8,500 and you pay $10 per generic pill, you’ll need 850 fills to hit the cap. That sounds like a lot-but if you take three pills a day, you’ll hit it in under a year. After that, your insurance pays 100%.

That’s the real win. You don’t need to meet your deductible to get relief. You just need to reach your out-of-pocket maximum. And generic copays are helping you get there-just not the way you think.

Why this system exists

The separation between deductibles and copays wasn’t an accident. It was a design choice. Insurers use it to keep premiums lower. If every copay counted toward the deductible, insurers would pay out more sooner. That would raise premiums across the board.But it’s also a trade-off. Simpler plans cost more. Separated plans cost less-but confuse more people. The system protects against catastrophic costs, but it doesn’t protect against confusion.

The ACA fixed one problem-catastrophic spending-but created another: complexity. And complexity leads to underuse. That’s why the next big change won’t be about cost. It’ll be about clarity.

Until then, know your plan. Track your spending. And don’t assume your copays are doing more than they are. They’re helping you reach your out-of-pocket maximum. That’s huge. But they’re not helping you meet your deductible. And that’s okay-as long as you know the difference.

Do generic prescription copays count toward my deductible?

In most cases, no. Generic prescription copays usually do not count toward your medical deductible. They count toward your out-of-pocket maximum, but not your deductible. This is true for about 73% of employer-sponsored plans that have separate medical and prescription cost-sharing structures. Always check your plan’s Summary of Benefits and Coverage document to confirm.

What counts toward my out-of-pocket maximum?

All in-network cost-sharing counts toward your out-of-pocket maximum: your deductible, coinsurance, and copays-including generic prescription copays. This includes payments for doctor visits, lab tests, hospital stays, and prescriptions. Monthly premiums and out-of-network care do not count.

Can I reach my out-of-pocket maximum just by paying copays?

Yes. If you take multiple prescriptions or have frequent doctor visits, you can reach your out-of-pocket maximum without ever paying your full deductible. For example, if your out-of-pocket max is $8,500 and you pay $10 per generic pill 850 times, you’ll hit the cap. After that, your insurance covers 100% of covered services for the rest of the year.

Why do some plans have separate prescription deductibles?

Separate prescription deductibles let insurers manage costs by making patients pay full price for meds until they hit a lower threshold-often $1,000. After that, copays kick in. This keeps premiums lower because the insurer pays less early in the year. But it also creates confusion, since those payments don’t help you meet your medical deductible.

What should I do if I’m confused about my plan?

Call your insurer and ask: “Do my generic prescription copays count toward my medical deductible?” Request the Summary of Benefits and Coverage document. Look for the line item that says “Does this payment count toward my deductible?” If it says “no,” your copays only count toward your out-of-pocket maximum. Write it down. Don’t rely on memory.